Corporate Banking PM II

Commercial Banking

Philadelphia, Pennsylvania; Charlotte, North Carolina; Chicago, Illinois; Boston, Massachusetts

Description

At Citizens, we work together to make a difference for companies that are building, supplying, and serving industries and consumers across the country. We are partners from a diverse set of backgrounds who truly listen — to understand where our clients are trying to go and bring the tools, data, and strategic insights to help them get there.

As a Corporate Banking Portfolio Manager II, you will be responsible for credit underwriting, monitoring, and portfolio management of new and existing commercial banking relationships to ensure strong credit quality and achieve efficient internal processes to retain and expand customer relationships. Additionally, you will be responsible for underwriting and effective credit and risk administration with particular emphasis on financial analysis/modeling, risk evaluation, ongoing portfolio maintenance activities, regulatory compliance, and customer support. In this role, you will manage a portfolio of the most complex credits and will be expected to perform your role responsibilities with limited supervision and exhibit expert knowledge of your clients/credits when interacting with peers, relationship managers, your team leader, and senior managers across departments.

Primary responsibilities include

- Managing a portfolio of the most complex credits and will perform the functions of the position with only periodic oversight and is expected to perform with very limited supervisory intervention.

- Exhibit expert knowledge of clients/credits included in the portfolio when interacting with peers, Relationship Manager, team leader, and senior managers across departments/work teams.

- Effective credit underwriting and credit and risk administration with particular emphasis on adherence to credit policy and requirements, financial analysis/modeling, risk evaluation, ongoing portfolio maintenance activities, and as needed client support for an assigned portfolio.

- Structure, underwrite, and document new business, renewals, and modifications as the credit expert within the first line of defense.

- Oversee assigned portfolio of credits, anticipate portfolio problems, and take action to develop solutions, handles multiple demands and competing priorities.

- Meet deadlines and schedules associated with maintaining portfolio compliance with credit and risk policies.

- Provide client management support for assigned portfolio, maintaining a regular level of direct client interaction and resolving the most complex issues related to credit monitoring and administration with clients directly.

- Understand and stay up to date on industry and market information related to assigned markets and customers.

- Shares insights and learnings with other RMs and PMs.

Qualifications, Education, Certifications and/or Other Professional Credentials

- Extensive Credit Expertise: Proven ability to manage and underwrite complex commercial credit relationships with minimal supervision, demonstrating deep understanding of credit policy, financial modeling, and risk evaluation.

- Advanced Financial Analysis Skills: Strong proficiency in financial statement analysis, cash flow modeling, and risk assessment to support sound credit decisions and portfolio management.

- Portfolio Management Experience: Demonstrated success in overseeing a diverse portfolio of high-complexity credits, anticipating potential issues, and implementing proactive solutions to maintain credit quality.

- Client-Focused Communication: Exceptional interpersonal and communication skills, with the ability to engage directly with clients to resolve complex credit issues and support relationship growth.

- Strategic Insight & Collaboration: Ability to synthesize market and industry data to inform credit decisions and share insights across teams, contributing to broader strategic goals.

- Regulatory & Policy Compliance: Deep understanding of regulatory requirements and internal credit policies, ensuring consistent adherence and timely portfolio maintenance.

- Leadership & Mentorship: Experience guiding peers and collaborating with relationship managers, team leaders, and senior stakeholders to drive credit excellence and share best practices.

Hours & Work Schedule

- Hours per Week: 40

- Work Schedule: M-F

Some job boards have started using jobseeker-reported data to estimate salary ranges for roles. If you apply and qualify for this role, a recruiter will discuss accurate pay guidance.

Equal Employment Opportunity

Citizens, its parent, subsidiaries, and related companies (Citizens) provide equal employment and advancement opportunities to all colleagues and applicants for employment without regard to age, ancestry, color, citizenship, physical or mental disability, perceived disability or history or record of a disability, ethnicity, gender, gender identity or expression, genetic information, genetic characteristic, marital or domestic partner status, victim of domestic violence, family status/parenthood, medical condition, military or veteran status, national origin, pregnancy/childbirth/lactation, colleague’s or a dependent’s reproductive health decision making, race, religion, sex, sexual orientation, or any other category protected by federal, state and/or local laws. At Citizens, we are committed to fostering an inclusive culture that enables all colleagues to bring their best selves to work every day and everyone is expected to be treated with respect and professionalism. Employment decisions are based solely on merit, qualifications, performance and capability.

Background Check

Any offer of employment is conditioned upon the candidate successfully passing a background check, which may include initial credit, motor vehicle record, public record, prior employment verification, and criminal background checks. Results of the background check are individually reviewed based upon legal requirements imposed by our regulators and with consideration of the nature and gravity of the background history and the job offered. Any offer of employment will include further information.

Benefits

We offer competitive pay, comprehensive medical, dental and vision coverage, retirement benefits, maternity/paternity leave, flexible work arrangements, education reimbursement, wellness programs and more.

View Benefits

Awards We've Received

Age-Friendly Institute’s Certified Age-Friend Employer

Dave Thomas Foundation’s Best Adoption-Friendly Workplace

Disability:IN Best Places to Work for Disability Inclusion

Human Rights Campaign Corporate Equality Index 100 Award

Fair360 Top Regional Company

FORTUNE’s World’s Most Admired Companies

Military Friendly® Employer

-

Corporate Banking PM II

Philadelphia, Pennsylvania; Charlotte, North Carolina; Chicago, Illinois; Boston, Massachusetts

Philadelphia, Pennsylvania, Charlotte, North Carolina, Chicago, Illinois, Boston, Massachusetts

View Job

-

Citizens Teller- Part Time

Philadelphia, Pennsylvania

Philadelphia, Pennsylvania

View Job

-

Citizens Teller- Part Time

Philadelphia, Pennsylvania

Philadelphia, Pennsylvania

View Job

-

-

Explore Life at Citizens Hear colleague stories, explore our culture and see how we support your growth at Citizens.

Explore Life at Citizens Hear colleague stories, explore our culture and see how we support your growth at Citizens. -

Community Being good citizens is at the heart of who we are. See how Citizens supports and strengthens communities, learn about banking careers and search our jobs.

Community Being good citizens is at the heart of who we are. See how Citizens supports and strengthens communities, learn about banking careers and search our jobs. -

Explore Our Career Areas with Citizens Citizens has roles in finance and beyond. Learn about our career areas and job types, how we support your success, and search our open jobs.

Explore Our Career Areas with Citizens Citizens has roles in finance and beyond. Learn about our career areas and job types, how we support your success, and search our open jobs. -

Business Banking Jobs Roles with our Business Banking team are for ambitious entrepreneurs. Here, growth is attainable, for your career, for your clients’ business, and for our company.

Business Banking Jobs Roles with our Business Banking team are for ambitious entrepreneurs. Here, growth is attainable, for your career, for your clients’ business, and for our company. -

Commercial Banking Careers at Citizens Discover rewarding roles in Commercial Banking where you'll help businesses grow through tailored financial solutions and strategic support.

Commercial Banking Careers at Citizens Discover rewarding roles in Commercial Banking where you'll help businesses grow through tailored financial solutions and strategic support. -

Corporate Jobs

Corporate Jobs -

Technology, Security & Digital At Citizens, we invest in the humans who build the logic, ideas, and innovations that bring new technologies to life.

Technology, Security & Digital At Citizens, we invest in the humans who build the logic, ideas, and innovations that bring new technologies to life. -

Mortgage Careers Join our mortgage team and help customer achieve homeownership with personalized guidance, innovative tools, and trusted expertise.

Mortgage Careers Join our mortgage team and help customer achieve homeownership with personalized guidance, innovative tools, and trusted expertise. -

Retail Banking Careers Be the face of Citizens. Explore customer-focused roles in our branches where you'll make an impact every day.

Retail Banking Careers Be the face of Citizens. Explore customer-focused roles in our branches where you'll make an impact every day. -

Job Seeker Resources Learn about Citizens' hiring process and tips for applications and interviews. Explore all of our job seeker resources and search our careers.

Job Seeker Resources Learn about Citizens' hiring process and tips for applications and interviews. Explore all of our job seeker resources and search our careers. -

Commitment to Pay Equity Citizens is committed to building a diverse, inclusive, and high-performing culture where everyone feels valued, respected, and heard and feels a sense of belonging.

Commitment to Pay Equity Citizens is committed to building a diverse, inclusive, and high-performing culture where everyone feels valued, respected, and heard and feels a sense of belonging. -

Corporate Responsibility Our commitment to continual environmental, social and governance (ESG) progress is woven into the fabric of our business, as we work to create a thriving, sustainable, inclusive future for all of our stakeholders.

Corporate Responsibility Our commitment to continual environmental, social and governance (ESG) progress is woven into the fabric of our business, as we work to create a thriving, sustainable, inclusive future for all of our stakeholders. -

What drives you? We strive to help our customers, colleagues and communities reach their potential. No matter what drives you, we'll support your goals with a culture that encourages mentoring and empowers you to put your ideas into action. Learn more about our Home Mortgage careers today.

What drives you? We strive to help our customers, colleagues and communities reach their potential. No matter what drives you, we'll support your goals with a culture that encourages mentoring and empowers you to put your ideas into action. Learn more about our Home Mortgage careers today. -

Our Journey for Social Equity We’re committed to creating a diverse, equitable and inclusive world. We’re proud of the meaningful progress we made in 2021 and are committed to continuing our efforts in 2022 and beyond.

Our Journey for Social Equity We’re committed to creating a diverse, equitable and inclusive world. We’re proud of the meaningful progress we made in 2021 and are committed to continuing our efforts in 2022 and beyond. -

Citizens Helping Citizens Giving back is part of our Credo. Citizens harnesses the power of our colleagues to impact communities across our footprint.

Citizens Helping Citizens Giving back is part of our Credo. Citizens harnesses the power of our colleagues to impact communities across our footprint. -

Benefits We’re committed to providing benefits, resources and programming to surface healthy habits and support the whole you, across all aspects of your life.

Benefits We’re committed to providing benefits, resources and programming to surface healthy habits and support the whole you, across all aspects of your life. -

Life at Citizens Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt.

Life at Citizens Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt. -

How I Grow Here | CJ Builds a Well-Rounded Career CJ, Head of Enterprise Experience Risk, has been with Citizens for 17 years and he’s got some wisdom to share.

How I Grow Here | CJ Builds a Well-Rounded Career CJ, Head of Enterprise Experience Risk, has been with Citizens for 17 years and he’s got some wisdom to share. -

What to Expect: Video Interview & Assessment Process Get ready with confidence. Learn how our video interview and assessment tools help us get to know you beyond your resume - and how you can prepare.

What to Expect: Video Interview & Assessment Process Get ready with confidence. Learn how our video interview and assessment tools help us get to know you beyond your resume - and how you can prepare. -

Career Growth & Development at Citizens With dedicated programs, advice and upskilling opportunities, you can build the career you want at Citizens.

Career Growth & Development at Citizens With dedicated programs, advice and upskilling opportunities, you can build the career you want at Citizens. -

Your Privacy Matters | Job Applicant Privacy Policy At Citizens, we value your trust. Learn how we collect, use, and protect your personal information during the job application process.

Your Privacy Matters | Job Applicant Privacy Policy At Citizens, we value your trust. Learn how we collect, use, and protect your personal information during the job application process. -

Citizens Annual AI Bias Audit | Ensuring Fair Hiring Practices Discover how Citizens conducts its annual AI bias audit to ensure fair and equitable hiring practices. Learn about our commitment to inclusivity in the recruitment process.

Citizens Annual AI Bias Audit | Ensuring Fair Hiring Practices Discover how Citizens conducts its annual AI bias audit to ensure fair and equitable hiring practices. Learn about our commitment to inclusivity in the recruitment process. -

Supporting Veterans and Military Families at Citizens Military members demonstrate the ultimate sacrifice. At Citizens, we're proud to support veterans, those who are serving, and those who support them.

Supporting Veterans and Military Families at Citizens Military members demonstrate the ultimate sacrifice. At Citizens, we're proud to support veterans, those who are serving, and those who support them. -

NextGen Learning at Citizens | Innovate Your Career Unlock your potential with NextGen Learning at Citizens. Discover cutting-edge training programs designed to enhance your skills and advance your career.

NextGen Learning at Citizens | Innovate Your Career Unlock your potential with NextGen Learning at Citizens. Discover cutting-edge training programs designed to enhance your skills and advance your career. -

Celebrating Those Who Live Our Credo We make it easy to recognize colleagues who live our values, drive innovation and volunteer in our communities.

Celebrating Those Who Live Our Credo We make it easy to recognize colleagues who live our values, drive innovation and volunteer in our communities. -

Well-being at Citizens We invest in supporting wellness across all dimensions of our colleagues’ lives. Care for the whole you is an essential cornerstone of our commitment to you.

Well-being at Citizens We invest in supporting wellness across all dimensions of our colleagues’ lives. Care for the whole you is an essential cornerstone of our commitment to you. -

How One Colleague Made Prioritizing Her Well-being Work Kendra, a colleague in our Universal Operations team, came in first place in our 2023 Move for Mental Health step challenge. Find out how she did it!

How One Colleague Made Prioritizing Her Well-being Work Kendra, a colleague in our Universal Operations team, came in first place in our 2023 Move for Mental Health step challenge. Find out how she did it! -

For Mark, Wellness Means Conscious Choices Hear about the moment our interim Head of Core Banking and Pittsburgh Market President made a wellness decision to prioritize a true work life balance.

For Mark, Wellness Means Conscious Choices Hear about the moment our interim Head of Core Banking and Pittsburgh Market President made a wellness decision to prioritize a true work life balance. -

Plan for clients, propel your career We’re a comprehensive firm with sophisticated wealth offerings for every client from mass affluent to ultra high net worth. We strive to help our customers, colleagues and communities reach their potential. Learn more about our careers in Wealth Management today.

Plan for clients, propel your career We’re a comprehensive firm with sophisticated wealth offerings for every client from mass affluent to ultra high net worth. We strive to help our customers, colleagues and communities reach their potential. Learn more about our careers in Wealth Management today. -

How Karen Stays “Grounded in Gratitude” Here’s how Karen, Head of Citizens Contact Center & Retail Transformation, navigates her health journey.

How Karen Stays “Grounded in Gratitude” Here’s how Karen, Head of Citizens Contact Center & Retail Transformation, navigates her health journey. -

Kirsten’s Journey from Couch to 5K and Beyond When the opportunity to join Team Citizens at the 2023 TCS NYC Marathon came up, Kirsten knew she had to throw her hat in the ring.

Kirsten’s Journey from Couch to 5K and Beyond When the opportunity to join Team Citizens at the 2023 TCS NYC Marathon came up, Kirsten knew she had to throw her hat in the ring. -

How I Grow Here | Maria Upskills Through Networking Meet Maria, an Engagement Manager at Citizens, and learn how her appetite to learn new skills, gain new experiences and expand her network helped her unlock her full potential.

How I Grow Here | Maria Upskills Through Networking Meet Maria, an Engagement Manager at Citizens, and learn how her appetite to learn new skills, gain new experiences and expand her network helped her unlock her full potential. -

Business Banking Colleague Spotlight Our Business Banking colleagues share how they feel supported by leadership and our culture of innovation.

Business Banking Colleague Spotlight Our Business Banking colleagues share how they feel supported by leadership and our culture of innovation. -

Virtual Volunteering with Citizens Giving back is at the core of what we do and embedded deep in Citizens’ culture. As distinguished former Citizens colleagues, we invite you to engage in any of these virtual/at-home volunteer activities to continue to make a difference in your community.

Virtual Volunteering with Citizens Giving back is at the core of what we do and embedded deep in Citizens’ culture. As distinguished former Citizens colleagues, we invite you to engage in any of these virtual/at-home volunteer activities to continue to make a difference in your community. -

We're hiring PCRMs in Southern New England! We're expanding our team of Private Client Relationship Managers in Southern New England. Learn more and apply today!

We're hiring PCRMs in Southern New England! We're expanding our team of Private Client Relationship Managers in Southern New England. Learn more and apply today! -

For Darnell, Well-being Begins with Balance When Darnell isn’t busy supporting our bustling Mergers & Acquisitions business, you can catch him getting some reps at the gym or hitting the heavy bag.

For Darnell, Well-being Begins with Balance When Darnell isn’t busy supporting our bustling Mergers & Acquisitions business, you can catch him getting some reps at the gym or hitting the heavy bag. -

How to Avoid Recruiting Scams | Tips from Citizens Learn how to protect yourself from recruiting scams with tips from Citizens Cyber Defense Team. Stay informed about common red flags, protect your personal information, and ensure your job search is safe and secure.

How to Avoid Recruiting Scams | Tips from Citizens Learn how to protect yourself from recruiting scams with tips from Citizens Cyber Defense Team. Stay informed about common red flags, protect your personal information, and ensure your job search is safe and secure. -

How I Grow Here | Melissa's Journey to Growth & Professional Success Discover how our Head of Enterprise Data and Analytics Transformation leaned into opportunities for development, empowering her to excel in her professional path.

How I Grow Here | Melissa's Journey to Growth & Professional Success Discover how our Head of Enterprise Data and Analytics Transformation leaned into opportunities for development, empowering her to excel in her professional path. -

Citizens Colleagues Build Playhouse for Veteran Family Discover how Citizens colleagues from the Veterans and Caring for Citizens BRGs teamed up to build a playhouse for a veteran family, embodying our commitment to service, collaboration and community support.

Citizens Colleagues Build Playhouse for Veteran Family Discover how Citizens colleagues from the Veterans and Caring for Citizens BRGs teamed up to build a playhouse for a veteran family, embodying our commitment to service, collaboration and community support. -

Democratizing Data Across Citizens We sat down with Krish Swamy, our Chief Data & Analytics Officer, to talk about big trends in the space, and his commitment to colleague upskilling in the discipline.

Democratizing Data Across Citizens We sat down with Krish Swamy, our Chief Data & Analytics Officer, to talk about big trends in the space, and his commitment to colleague upskilling in the discipline. -

Helping Colleagues Grow Their Families Through Adoption We’re proud of the recognition for the support, care, and resources we provide colleagues when they begin their parenthood journey. Read David's story of how Citizens and his team supported his journey to parenthood.

Helping Colleagues Grow Their Families Through Adoption We’re proud of the recognition for the support, care, and resources we provide colleagues when they begin their parenthood journey. Read David's story of how Citizens and his team supported his journey to parenthood. -

Consumer Bank Colleagues Battle on the Ice Colleagues across the Consumer Bank gathered for the 1st Annual Citizens Stanley Cup at a rink near our Johnston, RI campus.

Consumer Bank Colleagues Battle on the Ice Colleagues across the Consumer Bank gathered for the 1st Annual Citizens Stanley Cup at a rink near our Johnston, RI campus. -

Floorcare Maintenance Technicians | Apply Now Join Citizens as a Floorcare Maintenance Technician and help maintain clean, safe and welcoming facilities. Enjoy competitive benefits, including a company vehicle and health coverage. Explore opportunities in your region and apply today!

Floorcare Maintenance Technicians | Apply Now Join Citizens as a Floorcare Maintenance Technician and help maintain clean, safe and welcoming facilities. Enjoy competitive benefits, including a company vehicle and health coverage. Explore opportunities in your region and apply today! -

A Career That Makes An Impact Be part of our elite team of Private Client Relationship Managers and be the trusted advisor for your clients.

A Career That Makes An Impact Be part of our elite team of Private Client Relationship Managers and be the trusted advisor for your clients. -

Transforming Data & Analytics at Citizens If you embrace a 'test and learn' mentality and crave a culture that invests in its community of users, you're ready to help us transform the data and analytics space at Citizens.

Transforming Data & Analytics at Citizens If you embrace a 'test and learn' mentality and crave a culture that invests in its community of users, you're ready to help us transform the data and analytics space at Citizens. -

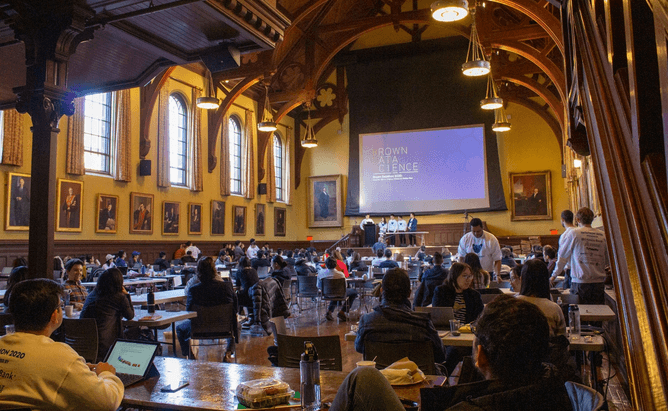

Data & Analytics Takes Centerstage at DataPulse We're on a journey to revolutionize data and insights at Citizens. DataPulse, our proprietary, annual data and analytics conference, is open to all colleagues to learn, network and upskill.

Data & Analytics Takes Centerstage at DataPulse We're on a journey to revolutionize data and insights at Citizens. DataPulse, our proprietary, annual data and analytics conference, is open to all colleagues to learn, network and upskill. -

Ready to make your mark in our Citizens Private Bank internship Gain exposure to Citizens Private Bank as a summer intern, helping to build and apply exceptional client-service skills and ingenuity to solve problems and enhance relationships with our clients.

Ready to make your mark in our Citizens Private Bank internship Gain exposure to Citizens Private Bank as a summer intern, helping to build and apply exceptional client-service skills and ingenuity to solve problems and enhance relationships with our clients. -

Ready for a sneak peek into a career in our Contact Centers Help our customers while growing your career. Join our Contact Center team today!

Ready for a sneak peek into a career in our Contact Centers Help our customers while growing your career. Join our Contact Center team today! -

Capital Markets & Advisory (CM&A) Programs Want to join one of the oldest and largest financial institutions in the country? Explore our internship and full-time programs today!

Capital Markets & Advisory (CM&A) Programs Want to join one of the oldest and largest financial institutions in the country? Explore our internship and full-time programs today! -

Explore our mortgage product suite Discover a full range of mortgage solutions offered at Citizens - from fixed-rate to first time homebuyer options.

Explore our mortgage product suite Discover a full range of mortgage solutions offered at Citizens - from fixed-rate to first time homebuyer options. -

Bring your skills to our Commercial Banker Development Program We’re looking for the next generation of talent to serve as trusted advisors to our clients; to understand where they’re going and bring the tools and insights needed to help them get there.

Bring your skills to our Commercial Banker Development Program We’re looking for the next generation of talent to serve as trusted advisors to our clients; to understand where they’re going and bring the tools and insights needed to help them get there. -

How I Grow Here | Joel's Tackling New Challenges Meet Joel, Project Manager for the Emerging Markets team in the Community Development organization. Hear how his eagerness to learn and embrace technology led to exciting new career growth.

How I Grow Here | Joel's Tackling New Challenges Meet Joel, Project Manager for the Emerging Markets team in the Community Development organization. Hear how his eagerness to learn and embrace technology led to exciting new career growth. -

Support for Caregivers and Parents At Citizens, we're committed to supporting working parents and caregivers. Discover the benefits, resources and flexibility we offer to help you care for others - while we care for you.

Support for Caregivers and Parents At Citizens, we're committed to supporting working parents and caregivers. Discover the benefits, resources and flexibility we offer to help you care for others - while we care for you. -

Citizens Community Service Sabbatical program Learn more about our pinnacle volunteer opportunity that invests in the growth of our colleagues and nonprofit partners by leveraging colleagues' skills and talents in new ways.

Citizens Community Service Sabbatical program Learn more about our pinnacle volunteer opportunity that invests in the growth of our colleagues and nonprofit partners by leveraging colleagues' skills and talents in new ways. -

Private Client Financial Advisor Careers Explore rewarding careers as a Private Client Financial Advisor at Citizens. Join a collaborative team, build lasting client relationships and shape your future in wealth management.

Private Client Financial Advisor Careers Explore rewarding careers as a Private Client Financial Advisor at Citizens. Join a collaborative team, build lasting client relationships and shape your future in wealth management. -

Tips on Creating a Caregiver-Friendly Resume Re-entering the workforce after caregiving? Learn how to update your resume, showcase your skills, and move forward with confidence.

Tips on Creating a Caregiver-Friendly Resume Re-entering the workforce after caregiving? Learn how to update your resume, showcase your skills, and move forward with confidence. -

Enterprise Data and Analytics Programs Calling all student and graduate data-driven thinkers! Eager to shape the future of banking? Explore our internship and full-time programs today!

Enterprise Data and Analytics Programs Calling all student and graduate data-driven thinkers! Eager to shape the future of banking? Explore our internship and full-time programs today! -

Enterprise Technology and Security Programs We're seeking innovative minds to drive technological transformation, build next-gen services, and shape the future of banking.

Enterprise Technology and Security Programs We're seeking innovative minds to drive technological transformation, build next-gen services, and shape the future of banking. -

Meet our Mortgage Leadership Team Discover the leaders driving innovation, culture and growth across Mortgage at Citizens. Learn more about the team shaping the future of home lending.

Meet our Mortgage Leadership Team Discover the leaders driving innovation, culture and growth across Mortgage at Citizens. Learn more about the team shaping the future of home lending. -

Caregiving Skills that Shine in the Workplace You've built real-world skills through caregiving, now see how they translate into strengths employers value. Learn how to confidently highlight your experience as you return to work.

Caregiving Skills that Shine in the Workplace You've built real-world skills through caregiving, now see how they translate into strengths employers value. Learn how to confidently highlight your experience as you return to work. -

Consumer Bank Enterprise Experience Programs Jumpstart your career through hands-on, impactful projects, comprehensive training, and exposure to executive leadership, paving the way for a robust career.

Consumer Bank Enterprise Experience Programs Jumpstart your career through hands-on, impactful projects, comprehensive training, and exposure to executive leadership, paving the way for a robust career. -

Guide to Behavioral Interviewing Learn how to have a successful behavioral interviewing experience.

Guide to Behavioral Interviewing Learn how to have a successful behavioral interviewing experience. -

Tips for Video Interviewing If you’re on the job search and part of an online recruiting process, check out these tips from our recruiting team on how to succeed at your next virtual interview.

Tips for Video Interviewing If you’re on the job search and part of an online recruiting process, check out these tips from our recruiting team on how to succeed at your next virtual interview. -

Students & Data Science Enthusiasts Converge at the BrownU DataThon Some of our top minds in the data science field and enthusiastic undergraduate talent convened for a weekend of data discovery.

Students & Data Science Enthusiasts Converge at the BrownU DataThon Some of our top minds in the data science field and enthusiastic undergraduate talent convened for a weekend of data discovery. -

Empowering the Workforce at the Annual Meet & Greet for Students with Disabilities The meet & greet helps students and recent graduates with disabilities identify their skills and hone their interview techniques.

Empowering the Workforce at the Annual Meet & Greet for Students with Disabilities The meet & greet helps students and recent graduates with disabilities identify their skills and hone their interview techniques. -

Celebrating our Colleagues’ Achievements: Big and Small Celebrating our colleagues is engrained in the Citizens culture. Learn about the different ways that we celebrate the achievements of our colleagues, every day.

Celebrating our Colleagues’ Achievements: Big and Small Celebrating our colleagues is engrained in the Citizens culture. Learn about the different ways that we celebrate the achievements of our colleagues, every day. -

Recognizing the Hard Work of our Colleagues during Credo Week Credo Week is an opportunity to take a moment and recognize the incredible workforce that has helped us grow into the leading financial institution we are today.

Recognizing the Hard Work of our Colleagues during Credo Week Credo Week is an opportunity to take a moment and recognize the incredible workforce that has helped us grow into the leading financial institution we are today. -

Finding the right career path: Guidance from our CEO, Bruce Van Saun Some lessons from our CEO Bruce Van Saun on career journeys and advancing your career.

Finding the right career path: Guidance from our CEO, Bruce Van Saun Some lessons from our CEO Bruce Van Saun on career journeys and advancing your career. -

Our Charlotte, NC Office is Uniting Forward-thinking Digital Minds We’re committed to growing out our digital capabilities with our Charlotte office build out and top-down organizational commitment.

Our Charlotte, NC Office is Uniting Forward-thinking Digital Minds We’re committed to growing out our digital capabilities with our Charlotte office build out and top-down organizational commitment. -

FinLit Volunteers at Citizens During Financial Literacy Month (and every month), we celebrate our FinLit volunteers who help make a difference in their customers' lives and the community they're a part of.

FinLit Volunteers at Citizens During Financial Literacy Month (and every month), we celebrate our FinLit volunteers who help make a difference in their customers' lives and the community they're a part of. -

Meet Aaron, Branch Manager & Seasoned Resident of Boston’s Chinatown Aaron is living out our values as the BM of his Chinatown branch, helping his branch team grow and actively giving back to his community.

Meet Aaron, Branch Manager & Seasoned Resident of Boston’s Chinatown Aaron is living out our values as the BM of his Chinatown branch, helping his branch team grow and actively giving back to his community. -

Meet Evan, active U.S. Army First Sergeant and Branch Manager in Derry, NH With the support of his branch colleagues and family, Evan is able to balance his role as First Sergeant for his unit and his Branch Manager position.

Meet Evan, active U.S. Army First Sergeant and Branch Manager in Derry, NH With the support of his branch colleagues and family, Evan is able to balance his role as First Sergeant for his unit and his Branch Manager position. -

Meet Omar, a Successful Banker and Proud Hispanic American Fluent in English, Spanish and Portuguese, Omar is proud to serve his community in Framingham, MA.

Meet Omar, a Successful Banker and Proud Hispanic American Fluent in English, Spanish and Portuguese, Omar is proud to serve his community in Framingham, MA. -

Herb Teaches Financial Literacy in Boston's Chinatown Neighborhood Relationship Manager Herb exemplifies our Credo with his financial literacy work in Boston’s Chinatown.

Herb Teaches Financial Literacy in Boston's Chinatown Neighborhood Relationship Manager Herb exemplifies our Credo with his financial literacy work in Boston’s Chinatown. -

Seven Must-dos Before Applying to Your Next Job On the job hunt? Check out this list of 7 must-dos before you begin hitting those application buttons!

Seven Must-dos Before Applying to Your Next Job On the job hunt? Check out this list of 7 must-dos before you begin hitting those application buttons! -

Citizens Continues Autism at Work Program Citizens is continuing to hire for their Autism at Work Program as part of their diversity and inclusion efforts.

Citizens Continues Autism at Work Program Citizens is continuing to hire for their Autism at Work Program as part of their diversity and inclusion efforts. -

Job Seeker Resource Center Articles and videos to help job seekers through career changes, job searching, interviewing, and more

Job Seeker Resource Center Articles and videos to help job seekers through career changes, job searching, interviewing, and more -

How Citizens Helped Neil's Appointment to the Board of a Nonprofit Thanks to Citizens’ investment in his growth, Neil was unanimously appointed to the board of a nonprofit.

How Citizens Helped Neil's Appointment to the Board of a Nonprofit Thanks to Citizens’ investment in his growth, Neil was unanimously appointed to the board of a nonprofit. -

Eight Questions to Ask During your Interview Impress your potential employer by asking these questions at your next interview!

Eight Questions to Ask During your Interview Impress your potential employer by asking these questions at your next interview! -

Our Locations Learn about the dynamic office locations and environments you could be working in as a Citizens colleague.

Our Locations Learn about the dynamic office locations and environments you could be working in as a Citizens colleague. -

From Challenging Start to Unstoppable The career journey of Renee, Business Banking SVP and Virtual Channel Director

From Challenging Start to Unstoppable The career journey of Renee, Business Banking SVP and Virtual Channel Director -

Our Johnston, RI Campus is Strengthening Collaboration & Benefiting the Community Our state-of-the art campus in Johnston, Rhode Island is located off I-295 and spans over 123 acres as the centralized hub for over 3,000 colleagues. The Johnston Campus brings significant benefits to the local community.

Our Johnston, RI Campus is Strengthening Collaboration & Benefiting the Community Our state-of-the art campus in Johnston, Rhode Island is located off I-295 and spans over 123 acres as the centralized hub for over 3,000 colleagues. The Johnston Campus brings significant benefits to the local community. -

Need help? We've got answers. Find answers to common questions about your job application, account access and navigating the Citizens career site.

Need help? We've got answers. Find answers to common questions about your job application, account access and navigating the Citizens career site. -

Be Supported for Who You Are - and All You Can Do As part of our commitment to building an inclusive workforce and world, Citizens is proud to offer a range of programs to support colleagues with differing abilities as they build new skills, grow their careers, and make an impact.

Be Supported for Who You Are - and All You Can Do As part of our commitment to building an inclusive workforce and world, Citizens is proud to offer a range of programs to support colleagues with differing abilities as they build new skills, grow their careers, and make an impact. -

Finding the Perfect Career Fit The career journey of Evanne, Home Equity Loan Specialist

Finding the Perfect Career Fit The career journey of Evanne, Home Equity Loan Specialist -

Writing Her Own Career Story The career journey of Mary, Senior Digital Content Management Partner

Writing Her Own Career Story The career journey of Mary, Senior Digital Content Management Partner -

A FinTech Veteran’s Perspective on Building an In-house Tech Firm Learn why Citizens is perfect for curious and motivated software engineers looking to build impactful solutions that affect millions of customers.

A FinTech Veteran’s Perspective on Building an In-house Tech Firm Learn why Citizens is perfect for curious and motivated software engineers looking to build impactful solutions that affect millions of customers. -

From Refurbishing Sneakers to Thriving at Citizens The career journey of Silavong, CDL Merch Relationship Support Partner.

From Refurbishing Sneakers to Thriving at Citizens The career journey of Silavong, CDL Merch Relationship Support Partner. -

Colleague Growth at Citizens Check out the career journeys of colleagues from around the organization, and across our footprint.

Colleague Growth at Citizens Check out the career journeys of colleagues from around the organization, and across our footprint. -

Time to Transform Your Career – and the Financial Future We’re taking our brand national – and reinventing the way people manage money. We need talented, strategic and creative professionals to help blaze the way. Are you ready?

Time to Transform Your Career – and the Financial Future We’re taking our brand national – and reinventing the way people manage money. We need talented, strategic and creative professionals to help blaze the way. Are you ready? -

Celebrating Pride 365: Fostering a culture of inclusion Celebrating Pride is a reflection of Citizens' commitment to supporting LGBTQ + communities and fostering a more inclusive world.

Celebrating Pride 365: Fostering a culture of inclusion Celebrating Pride is a reflection of Citizens' commitment to supporting LGBTQ + communities and fostering a more inclusive world. -

Mergers & Acquisitions Hub Mergers and acquisitions are part of our strategy. Citizens is ready to earn its place as a valued part of our new communities. We're here to listen and help our customers, colleagues and communities. Here are some questions you may have as a job seeker, candidate or current colleague of a company we recently acquired.

Mergers & Acquisitions Hub Mergers and acquisitions are part of our strategy. Citizens is ready to earn its place as a valued part of our new communities. We're here to listen and help our customers, colleagues and communities. Here are some questions you may have as a job seeker, candidate or current colleague of a company we recently acquired. -

Innovation Starts with You Your manager can do it. Your teammates can do it. YOU can do it! At Citizens, every colleague – at every level of our organization – has a unique opportunity to build a great career – and transform the future of banking.

Innovation Starts with You Your manager can do it. Your teammates can do it. YOU can do it! At Citizens, every colleague – at every level of our organization – has a unique opportunity to build a great career – and transform the future of banking. -

Educational Assistance Program Discover how Citizens supports your professional growth with our Educational Assistance Program. From financial support to skill development, explore our commitment to helping you build a rewarding career.

Educational Assistance Program Discover how Citizens supports your professional growth with our Educational Assistance Program. From financial support to skill development, explore our commitment to helping you build a rewarding career. -

How Lisa Made the Most of Mentorship Lisa, a Retail Banking Director for the Upper Mid-Atlantic region and a 33-year Citizens veteran, recently shared in her own words what it means to have a mentor and be a mentor.

How Lisa Made the Most of Mentorship Lisa, a Retail Banking Director for the Upper Mid-Atlantic region and a 33-year Citizens veteran, recently shared in her own words what it means to have a mentor and be a mentor. -

How a "Just do it!" Mentality Led to Career Growth Mo, head of Transactions Processing for Consumer Operations and a 21-year Citizens veteran, recently shared in his own words the importance of continuously learning, growing and being encouraged by his mentors to pursue new career opportunities.

How a "Just do it!" Mentality Led to Career Growth Mo, head of Transactions Processing for Consumer Operations and a 21-year Citizens veteran, recently shared in his own words the importance of continuously learning, growing and being encouraged by his mentors to pursue new career opportunities. -

Explore our Properties and Procurement Programs today Kick off your career by diving into real-world projects, getting solid training and support, and connecting with top leaders along the way.

Explore our Properties and Procurement Programs today Kick off your career by diving into real-world projects, getting solid training and support, and connecting with top leaders along the way. -

Finance & Accounting Career Training (FACT) Programs Launch your career journey with meaningful, hands-on projects, training and development, and face-time with senior leadership — all setting the stage for a strong future at Citizens.

Finance & Accounting Career Training (FACT) Programs Launch your career journey with meaningful, hands-on projects, training and development, and face-time with senior leadership — all setting the stage for a strong future at Citizens. -

Human Resources Program Discover how you can shape the future of banking by joining our Human Resources team—where people, purpose, and progress come together to drive meaningful impact.

Human Resources Program Discover how you can shape the future of banking by joining our Human Resources team—where people, purpose, and progress come together to drive meaningful impact. -

Internal Audit Programs We’re looking for motivated, detail-oriented individuals eager to kickstart their career in Internal Audit.

Internal Audit Programs We’re looking for motivated, detail-oriented individuals eager to kickstart their career in Internal Audit. -

Risk Management Program Explore how our Risk Management Development Program equips you with the skills and experience to tackle real-world financial challenges and build a dynamic career in risk.

Risk Management Program Explore how our Risk Management Development Program equips you with the skills and experience to tackle real-world financial challenges and build a dynamic career in risk. -

Treasury & Balance Sheet Strategies Graduate Rotational Program Want to launch a dynamic career in finance with real impact? Our Treasury & Balance Sheet Strategies Program offers an exceptional opportunity to grow, lead, and learn.

Treasury & Balance Sheet Strategies Graduate Rotational Program Want to launch a dynamic career in finance with real impact? Our Treasury & Balance Sheet Strategies Program offers an exceptional opportunity to grow, lead, and learn. -

Mastering Your LinkedIn Profile As A Caregiver Tips for caregivers and parents to confidently update their LinkedIn profiles, highlight transferable skills, and shine professionally.

Mastering Your LinkedIn Profile As A Caregiver Tips for caregivers and parents to confidently update their LinkedIn profiles, highlight transferable skills, and shine professionally. -

How I Grow Here | Joe's Skills are Opening New Doors Learn how Joe has translated his diverse skillset from hospitality and fashion to financial services.

How I Grow Here | Joe's Skills are Opening New Doors Learn how Joe has translated his diverse skillset from hospitality and fashion to financial services. -

Understanding the Interviewing Process: Roles, Tips, and What to Expect As you move through the interview journey, you’ll interact with several colleagues, each playing a unique role in building our team. Here’s a quick guide to who you might meet and how to make the most of each interaction.

Understanding the Interviewing Process: Roles, Tips, and What to Expect As you move through the interview journey, you’ll interact with several colleagues, each playing a unique role in building our team. Here’s a quick guide to who you might meet and how to make the most of each interaction. -

Contact Center Colleague Spotlight Read real colleague testimonials from our Contact Center team, highlighting career growth, innovation, leadership support, and culture.

Contact Center Colleague Spotlight Read real colleague testimonials from our Contact Center team, highlighting career growth, innovation, leadership support, and culture. -

Home Mortgage Colleague Spotlight Discover why our mortgage experts chose Citizens and how they find purpose in every step of the lending journey.

Home Mortgage Colleague Spotlight Discover why our mortgage experts chose Citizens and how they find purpose in every step of the lending journey. -

Bella TEST Test test test

Bella TEST Test test test -

The Rise of Skills-Based Hiring: Why Soft Skills Matter More Than Ever Discover why soft skills like communication, adaptability, and emotional intelligence are essential in today’s job market. Learn how to highlight them on your resume and in interviews—especially as more companies, like Citizens, embrace skills-based hiring.

The Rise of Skills-Based Hiring: Why Soft Skills Matter More Than Ever Discover why soft skills like communication, adaptability, and emotional intelligence are essential in today’s job market. Learn how to highlight them on your resume and in interviews—especially as more companies, like Citizens, embrace skills-based hiring. -

Lateral vs. Upward Career Moves: How to Choose the Right Path for Your Growth Explore the pros and cons of lateral vs. upward career moves. Learn how to choose the right path for your goals, build new skills, and grow your career with confidence—whether you're aiming higher or looking to broaden your experience.

Lateral vs. Upward Career Moves: How to Choose the Right Path for Your Growth Explore the pros and cons of lateral vs. upward career moves. Learn how to choose the right path for your goals, build new skills, and grow your career with confidence—whether you're aiming higher or looking to broaden your experience. -

From Experience to Opportunity: Mapping Your Transferable Skills What are transferable skills? How to find and use yours to grow your career.

From Experience to Opportunity: Mapping Your Transferable Skills What are transferable skills? How to find and use yours to grow your career. -

Banking on Change: How Grace's Career Pivot from Banker to Human Resources is Driving Impact at Citizens We spoke with Grace to learn more about her path, the challenges she faced, and the insights she’s gained along the way.

Banking on Change: How Grace's Career Pivot from Banker to Human Resources is Driving Impact at Citizens We spoke with Grace to learn more about her path, the challenges she faced, and the insights she’s gained along the way. -

Inside Citizens: How Our Team Builds Meaningful Careers How I Grow Here is a colleague spotlight series at Citizens that highlights real career journeys. Through bold moves, reflection, and support, colleagues grow in unexpected ways. This series inspires others to explore new paths and own their career development.

Inside Citizens: How Our Team Builds Meaningful Careers How I Grow Here is a colleague spotlight series at Citizens that highlights real career journeys. Through bold moves, reflection, and support, colleagues grow in unexpected ways. This series inspires others to explore new paths and own their career development. -

Breaking Into Networking: Tips for Job Seekers Starting from Square One New to networking? Start here. Whether you're launching your career or switching paths, this guide offers practical tips to build connections from scratch—using LinkedIn, events, volunteering, and more. Learn how to grow your network with confidence and purpose.

Breaking Into Networking: Tips for Job Seekers Starting from Square One New to networking? Start here. Whether you're launching your career or switching paths, this guide offers practical tips to build connections from scratch—using LinkedIn, events, volunteering, and more. Learn how to grow your network with confidence and purpose. -

The Power of Informational Interviews: Real Advice for Career Seekers Discover how informational interviews can guide your career path, build your network, and boost confidence—one conversation at a time.

The Power of Informational Interviews: Real Advice for Career Seekers Discover how informational interviews can guide your career path, build your network, and boost confidence—one conversation at a time. -

7 Surprising Careers You Can Find at a Financial Company (That Aren’t in Banking) Think finance is just banking? Think again. Explore 7 unexpected careers at financial companies that blend tech, creativity, and strategy.

7 Surprising Careers You Can Find at a Financial Company (That Aren’t in Banking) Think finance is just banking? Think again. Explore 7 unexpected careers at financial companies that blend tech, creativity, and strategy. -

Starting an Internship? Here's How to Prepare and Set Yourself Up for Success Kickstart your internship with confidence! Learn how to prepare, set goals, and make the most of your experience from day one.

Starting an Internship? Here's How to Prepare and Set Yourself Up for Success Kickstart your internship with confidence! Learn how to prepare, set goals, and make the most of your experience from day one. -

7 Simple Ways to Make the Most of Your Internship Make your internship count! Discover 7 easy ways to grow skills, build connections, and set yourself up for future career success.

7 Simple Ways to Make the Most of Your Internship Make your internship count! Discover 7 easy ways to grow skills, build connections, and set yourself up for future career success. -

Beyond the Paycheck: What to Look for in a Job Benefits Package Benefits matter! Learn what to look for in a job offer—from health and retirement to growth and culture—to build a strong foundation for your future.

Beyond the Paycheck: What to Look for in a Job Benefits Package Benefits matter! Learn what to look for in a job offer—from health and retirement to growth and culture—to build a strong foundation for your future. -

You Belong Here: Understanding and Conquering Imposter Syndrome at Work Struggling with imposter syndrome? Learn how to recognize it, reframe your mindset, and build confidence in your role—you do belong here.

You Belong Here: Understanding and Conquering Imposter Syndrome at Work Struggling with imposter syndrome? Learn how to recognize it, reframe your mindset, and build confidence in your role—you do belong here. -

Career Planning Made Simple: Your 1-Year, 3-Year, and 5-Year Success Strategy Map your future with a 1-, 3-, and 5-year career plan. Learn how to set goals, grow your skills, and stay adaptable as your journey evolves.

Career Planning Made Simple: Your 1-Year, 3-Year, and 5-Year Success Strategy Map your future with a 1-, 3-, and 5-year career plan. Learn how to set goals, grow your skills, and stay adaptable as your journey evolves. -

Master Your Elevator Pitch: A Quick Guide for Career Success Learn how to craft a strong elevator pitch that highlights your strengths, goals, and personality—perfect for interviews, networking, and career fairs.

Master Your Elevator Pitch: A Quick Guide for Career Success Learn how to craft a strong elevator pitch that highlights your strengths, goals, and personality—perfect for interviews, networking, and career fairs. -

ATS Resume Guide: How to Set Yourself Up for Applicant Tracking System Success Learn how to optimize your resume for Applicant Tracking Systems (ATS) and boost your chances of landing interviews. This guide covers what ATS software does, why employers use it, and practical tips to make your resume ATS-friendly—from formatting and keywords to file types and common mistakes to avoid.

ATS Resume Guide: How to Set Yourself Up for Applicant Tracking System Success Learn how to optimize your resume for Applicant Tracking Systems (ATS) and boost your chances of landing interviews. This guide covers what ATS software does, why employers use it, and practical tips to make your resume ATS-friendly—from formatting and keywords to file types and common mistakes to avoid. -

What to Expect in a Video On-Demand Interview and How to Prepare Like a Pro Video on-demand interviews are changing how candidates connect with employers. Learn how to prepare, present yourself professionally, and answer questions confidently—even without a live interviewer. From using the STAR method to practicing with a timer, these tips will help you stand out and make a lasting impression.

What to Expect in a Video On-Demand Interview and How to Prepare Like a Pro Video on-demand interviews are changing how candidates connect with employers. Learn how to prepare, present yourself professionally, and answer questions confidently—even without a live interviewer. From using the STAR method to practicing with a timer, these tips will help you stand out and make a lasting impression. -

How to Make Your LinkedIn Profile Stand Out to Recruiters Boost your LinkedIn visibility with expert tips to optimize your profile, attract recruiters, and stand out in today’s competitive job market.

How to Make Your LinkedIn Profile Stand Out to Recruiters Boost your LinkedIn visibility with expert tips to optimize your profile, attract recruiters, and stand out in today’s competitive job market. -

Citizens Alumni Community Citizens supports our alumni at work, at home, and in your community. We’re committed to helping our former employees thrive, and invite you to reconnect and explore opportunities at Citizens.

Citizens Alumni Community Citizens supports our alumni at work, at home, and in your community. We’re committed to helping our former employees thrive, and invite you to reconnect and explore opportunities at Citizens. -

Betting on Herself The career journey of Kristy, Human Resources Development Consultant

Betting on Herself The career journey of Kristy, Human Resources Development Consultant -

Curiosity and Commitment The career journey of Jessika, ESG Product Associate of Commercial Liquidity

Curiosity and Commitment The career journey of Jessika, ESG Product Associate of Commercial Liquidity -

Ready to Protect our Customers A career with our Fraud Operations team is ideal for self-motivated people who desire to be best-in-class, delivering an exceptional customer experience.

Ready to Protect our Customers A career with our Fraud Operations team is ideal for self-motivated people who desire to be best-in-class, delivering an exceptional customer experience. -

Bringing Her Whole Self to Work Hear from Kavita, SVP, Director of Product Strategy & Merchant Services with the Commercial Bank, about the impact her Asian American and Pacific Islander (AAPI) heritage has had on her life.

Bringing Her Whole Self to Work Hear from Kavita, SVP, Director of Product Strategy & Merchant Services with the Commercial Bank, about the impact her Asian American and Pacific Islander (AAPI) heritage has had on her life. -

Hear from our Early Career Program Alumni Our Early Career Development Program (ECDP) ensures that you get a versatile, interesting mix of experience in various disciplines and fields - with mentors and peers to support you along the way.

Hear from our Early Career Program Alumni Our Early Career Development Program (ECDP) ensures that you get a versatile, interesting mix of experience in various disciplines and fields - with mentors and peers to support you along the way. -

Robert’s Career Journey From Client to Colleague Hear Robert share how he went from a loyal customer, to working at Citizens.

Robert’s Career Journey From Client to Colleague Hear Robert share how he went from a loyal customer, to working at Citizens.